Error While Verifying Pan Please Try Again Later

In a general consequence regarding the mismatch in names occurring in the PAN card and Aadhaar menuhas been surging day past twenty-four hour period equally in the mutual process to link the Aadhaar menu to the tax render file, the upshot of name mismatch recurring in every taxpayer awarding. Every bit the regime has mandated the linking of Aadhaar cards while filing income tax render, the issue has been stagnant if you are unable to link PAN with Aadhaar as for a while and to revoke the effect, the authorities has summed up solutions regarding the name mismatch trouble and has ordered that if whatever proper noun mismatch occurrence persists, the taxpayer can take the option to attach a scanned copy of his her PAN card with the file.

These are the following Important Steps to Link Aadhaar with PAN Carte du jour

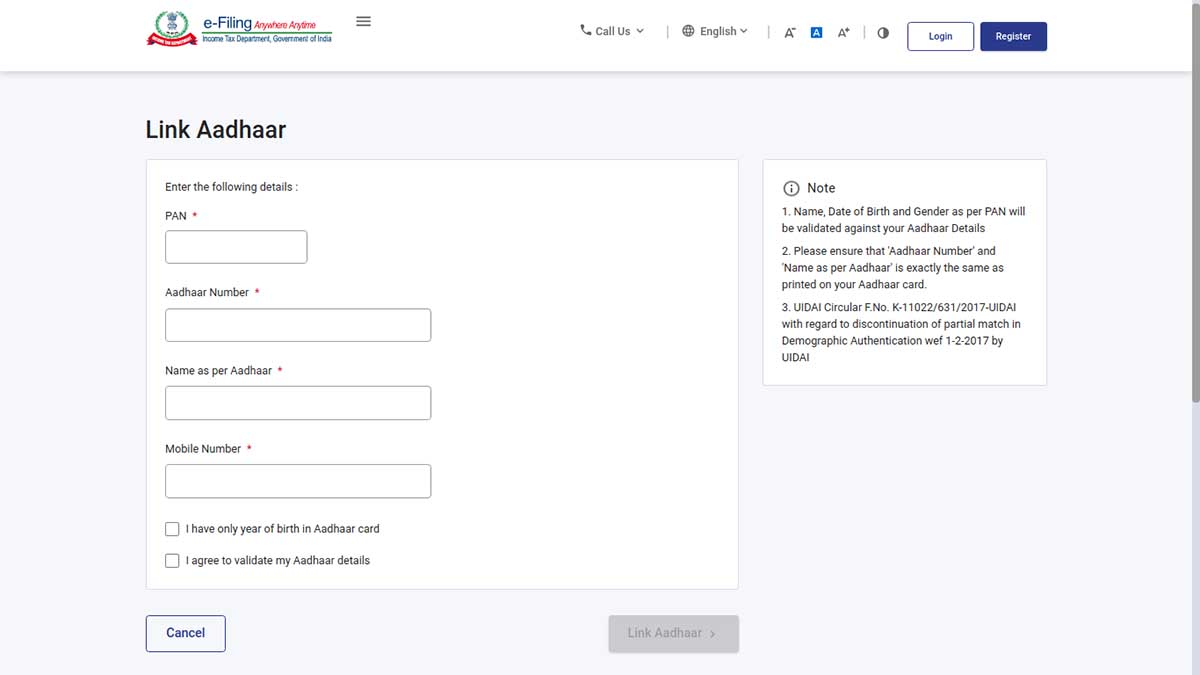

The Income Taxation Department has disclosed how to Link PAN with Aadhaar in just simple steps. In fact, it doesn't require to login or register at the eastward- filing website. Anyone tin avail this facility and link their Aadhaar with PAN. Simply follow the simple steps given beneath and link your Aadhaar with PAN:-

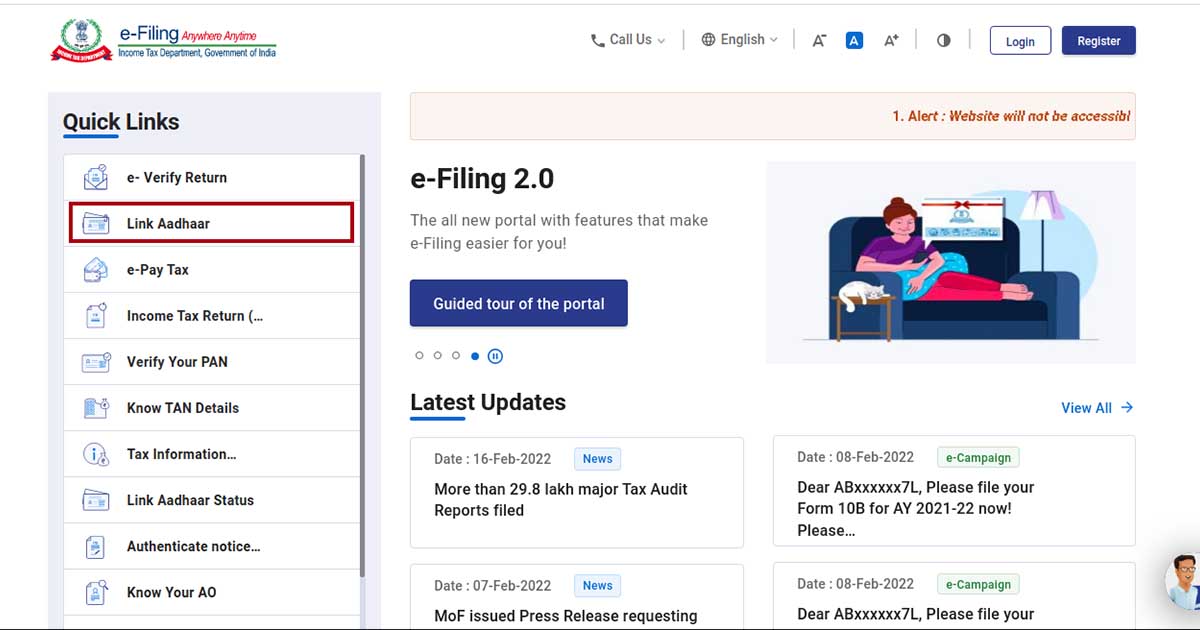

Footstep ane: Visit www.incometaxindiaefiling.gov.in and click on the left-hand side of the website nether Services menu> Link Aadhaar.

Step 2: Mentioned the required details, PAN number, Aadhaar number, and name, must ensure that you have ENTER NAME EXACTLY AS GIVEN IN AADHAAR Menu (avoid spelling mistakes) and submit.

UIDAI is the government website for Aadhaar. Afterwards the verification from UIDAI, the linking will automatically confirm.

Step 3: If in a case there is whatever slight difference between Aadhaar name provided by the taxpayer as compared to the bodily proper name in Aadhaar. One-Time Password (Aadhaar OTP) volition exist sent to the registered mobile number with Aadhaar. Taxpayers or candidates must sure that the date of nativity and gender in PAN and Aadhaar are exactly the aforementioned.

If in a instance, Aadhaar proper name must ensure that you have ENTER NAME EXACTLY Equally GIVEN IN AADHAAR CARD (avert spelling mistakes) and submit.

Apart from this, the government authority has also proposed to include a column on the official website of revenue enhancement department in which a link volition be provided to link the Aadhaar card past which an OTP volition be generated in any name mismatch scenario occurs. The OTP will come through the text message on the registered mobile number of the taxpayer and after inbound the received OTP on the portal, the linking will exist established between the Aadhaar bill of fare and the PAN card. The just condition which will fulfil this service is that the birth appointment must be same on both cards in lodge to finalise the linking process.

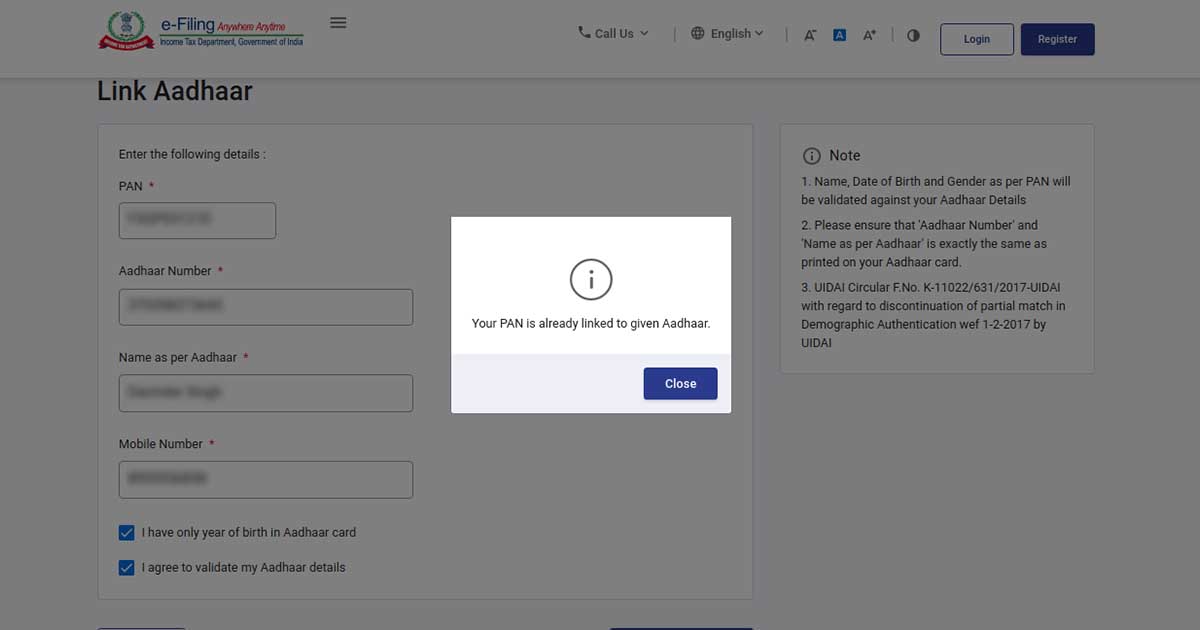

Pace iv: Later on filling out all the details and Aadhaar number, the organization will show the message if in case your Aadhaar is linked with the PAN.

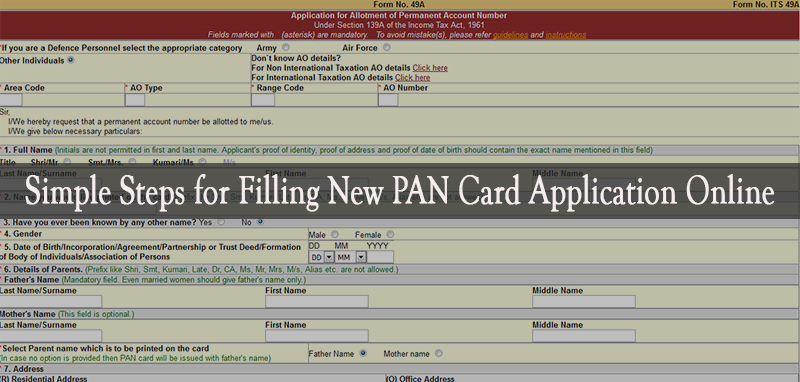

Read Also: Simple Steps for Filling New PAN Card Application Online  Get to know the easy steps about filling Permanent Account Number (PAN) card awarding through online. Too know the list of mandatory documents

Get to know the easy steps about filling Permanent Account Number (PAN) card awarding through online. Too know the list of mandatory documents

The name mismatch issue was being persistent after the matrimony minister Arun Jaitley has proposed in the financial bills of GST to mandate the linking of Aadhaar card in every filing of tax render. While some of the common problems regarding the linking of PAN menu to the Aadhar card are, special graphic symbol recognition, in which the Aadhaar carte is unable to recognize any special while on the same side PAN card is able to recognize the special characters. The 2nd issue in the row comes equally the initial recognition in which the Aadhaar card is unable to recognize the initials whereas the PAN carte takes the initials. Finally, the indicate of the middle name is likewise prevalent in the mismatch outcome, as the Indian customs changes the surname after the spousal relationship especially females, which in turn give a rise in the proper noun mismatch.

One must remember, that the linking of both Aadhaar bill of fare and PAN card is only eligible in the instance of name mismatch, is when the nativity date of the individual is mentioned same on both government IDs. This has been mandated past the regime as it will help in identifying the taxpayer identity on a house footing.

Who all are Exempted from Linking Aadhaar Card and PAN

Co-ordinate to the central government and supreme court orders, there is a necessary for the linking of Aadhaar and PAN as besides notified in the income tax department rules and regulations. The section 139AA was held by the court while the central board of excise and customs also released notification mentioning all the exempted entities for the linking.

The following list specifies the exempted individuals on which the section 139AA is not applicable:

- Those categorised as Non-resident Indians as per the Income Tax Laws

- Not a denizen of India

- Is of age 80 years or more than at any fourth dimension during the tax year

- Residents of united states of Assam, Meghalaya and Jammu and Kashmir

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Whatsoever change in detail or information other than fact must exist considered a human error. The blog we write is to provide the updated information. Y'all can raise any query on matters related to blog content. Also, notation that we don't provide any type of consultancy so we are sorry for unable to reply to consultancy queries."

Source: https://blog.saginfotech.com/solved-name-mismatch-problem-aadhar-and-pan-card-for-itr-filing

Post a Comment for "Error While Verifying Pan Please Try Again Later"